You’ve probably heard about this in the news, but in the coming days Western Washington homeowners will receive their annual property tax bill, and for many the increase will be shockingly high. Just how high? Let’s take a moment to commiserate with those in Carnation who will see the largest increase at 31%. The good news is that the average increase is only around 17% and as you’ll read below, voters agreed to these raises to fund bonds and levies for schools, fire protection, and veterans, to name a few.

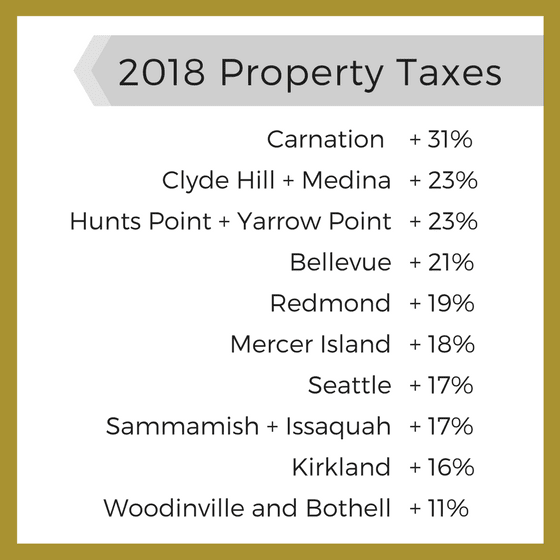

Here’s a quick breakdown at what these new taxes look like around the area:

More detailed information on each city can be found on the King County Assessor’s published analysis here.

If you want to check out exactly what your bill will look like, click the link below to get to the Assessor’s search page. Note: you’ll need your tax parcel number. Don’t know it? Give us a call and we can give it to you.

About half of the property tax bill is the result of local, voter-approved measures. Property tax revenues collected will go toward fire protection levies in Maple Valley , the renewal of the veterans, seniors and Human Services levy in King County, and school bonds for Shoreline and Federal Way. Even more levies were approved in last week’s election, including three for Bellevue schools.

In total, about 57 percent of property tax revenues will go toward schools. These local increases have combined with the budget passed by the state legislature to fully fund basic education. That funding formula — roughly an extra $1.01 for every $1,000 in assessed property value — hits our metro Puget Sound region particularly hard, where home values are drastically higher.

Voters approved three levies for the Bellevue School district last week that will generate $475 million over four years.

FEDERAL TAX CHANGES TO KNOW

Taking a broader look, there are several changes on the federal side that might also impact you:

• A Decrease in the Mortgage Interest Deduction Cap from $1,000,000 at $750,000

• A Cap on State and Local Property Tax Deductions at $10,000 per return.

• Moving Expenses Deduction Repealed (Military Moves Exempted)

• Casualty Loss Deduction Repealed.

Keep in mind, many of these changes only apply to those that itemize their deductions. As always, your accountant or financial advisor will know best how these changes will affect you.

For more information on the recent tax changes click here.