When mortgage rates get high, buyers are often quickly priced out of homes they were able to afford just months ago. This leads to unhappy buyers AND sellers. However, there's a Win/Win scenario for everyone involved – the Seller-Paid Rate Buydown. We're going to through what this looks like, why you should (or shouldn't) take a advantage of buydowns, and give a quick over view of the usual buydown options. Let's get into it!

What Is a Buydown?

A buydown is a mortgage financing technique with which the buyer attempts to obtain a lower interest rate for at least the first few years of the mortgage or possibly its entire life. A 2-1 buydown, for example, is a specific type of mortgage buydown that allows homebuyers to save on their interest rate for the first two years of the loan. Buydowns can also use a 3-2-1 structure as well.

What Is A Seller-Paid Rate Buydown?

Lenders allow the seller of a home to “credit” a portion of their proceeds to the home buyer. This is called a seller concession. Seller concessions can be used to pay a buyer’s closing costs only, and cannot be used to help with the down payment.

What experienced mortgage and real estate professionals know is that seller concessions can also be used to pay mortgage points and buy down the interest rate.

The whole idea for the seller-paid rate buydown is to get money back from the seller to permanently buy down the interest rate. The majority of mortgage professionals will distribute the seller funds to underwriting costs, escrow fees, and loan fees…not many of them think to permanently buy down the interest rate on the loan which significantly reduces the monthly mortgage payment.

Who Benefits From A Seller-Paid Rate Buydown?

At first thought, it may seem like a seller-paid rate buydown only benefits the buyer, however in a high rate environment, especially for higher-priced homes - the go-to solution is for the seller to reduce the asking price of the home. But sometimes there's no more room in the price point, and it's often better for both parties to buydown instead of reduce price.

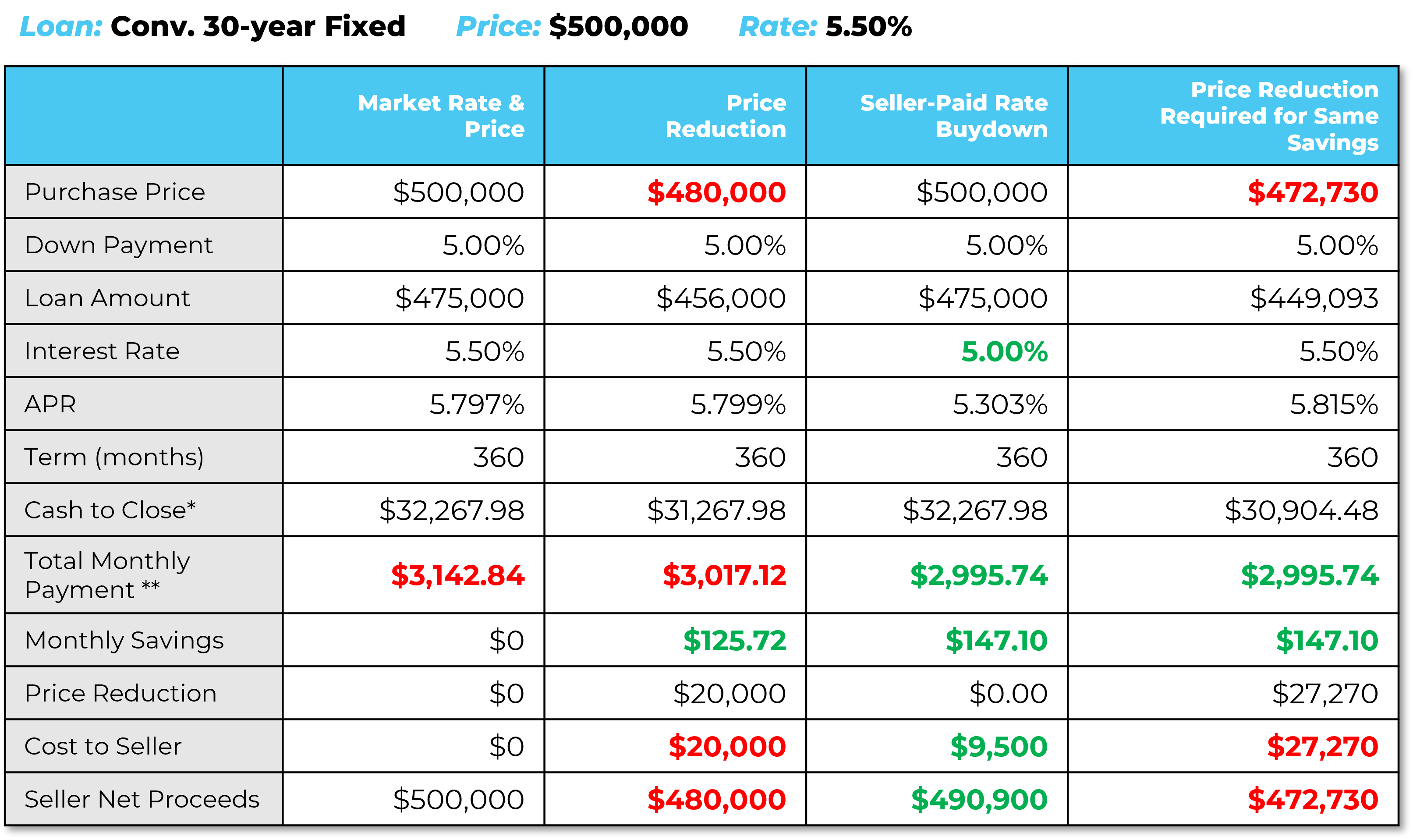

Below is a sample of a loan comparison showing options for purchasing a $500,000 home using a 30-year fixed-rate mortgage at a 5.5% interest rate.

For this example, let’s say the buyer is only able to qualify for a monthly payment of $3,000. As you can see in the first column showing the market rate and price, the buyer would not be able to afford the home in this scenario.

Price Reduction Strategy

Take a look at how this would change if the seller reduced the price of the home by $20,000. This change would result in some savings for the buyer, but the required monthly payment would still be too high. This strategy would also reduce the seller’s net profit by $20,000 – a considerable amount.

Seller-Paid Rate Buydown Strategy

Now look at what would happen if the seller paid 2 points to buy down the interest rate by .5%. Not only would this option reduce the monthly payment enough to what the buyer could qualify for, it would also increase the seller’s net profit by $10,500 compared to the price reduction strategy.

To take it a step further, the final column shows how much the seller would actually have to reduce the price of the home to reach the same monthly payment as the rate buydown strategy – $27,270, which is nearly 3 times the cost.

And finally, by reducing the interest rate, the buyer will realize more savings over the life of their loan – not just upfront.

Buydown Pros and Cons

Whether it makes sense to use a buydown to purchase a home can depend on several things, including the amount of the mortgage, your initial interest rate, the amount you could save in interest over the initial loan term, and your estimated future income. How long you plan to stay in the home also can come into play for determining your break-even point.

-

A buydown temporarily reduces your interest rate, saving you money and lowering your monthly payments during the initial loan term.

- Choosing a buydown could save you money on interest costs during the first two years (with a 2-1 buydown) or three years (with a 3-2-1 buydown) of the mortgage.

-

Choosing a buydown may allow you to pay less for the home than the seller’s listing price.

- If a seller is offering to pay something toward the buydown, then this could reduce the cost of buying the home.

-

It could make sense for homebuyers whose income will increase in the years to come.

- If you’re just starting your career and your income is expected to rise, then you may not have any issues with making your higher mortgage payments over time.

-

Once the buydown rate ends, your monthly payment could be higher than expected.

- Once the initial rate period ends, your monthly payments could be substantially higher than what you’re used to. That could be problematic if your income has dropped since purchasing the home.

-

A buydown may not be an option for certain property types or loan types.

- Your ability to take advantage of a buydown may be limited by the type of property involved or the type of mortgage loan for which you’re applying.

-

If your income doesn’t increase, then you could struggle with making monthly mortgage payments.

-

If you’re not able to make the higher payments after the initial buydown period then you could be at greater risk of losing the home to foreclosure.

-

Remember to consider both the up-front costs of buying a home, such as the down payment or closing costs, and the ongoing costs to understand how much you can afford to become a homeowner.

When to Use a Buydown

A buydown could make sense for buyers if it allows them to get a mortgage without significantly increasing the purchase price of the home or draining their cash reserves. Buydowns also may be more appropriate for people who have stable income set to grow over the life of the loan, making it easier to keep up with payment increases once the initial rate period ends.

But again, timing matters. If you don’t plan to stay in the home for at least five years, then you might not see any real savings at all from a buydown. So consider your future plans for buying a home and how long you might stay put before committing to a mortgage buydown.

Also, remember that not every mortgage is eligible for a buydown. For example, you can't use them to purchase an investment property or for cash-out refinancing. Government-backed loans, such as FHA loans and USDA loans, also have specific guidelines regarding buydowns and when they can be used.

Other Ways to Reduce Mortgage Rates

Alternatively, buyers can choose to pay for discount points to buy down their interest rate. In this scenario, the buyer pays money up front to purchase the points, and the lender reduces their interest rate as a result. Discount points can lower the interest rate on a mortgage for the life of the loan, rather than just for the first two years.2

A buydown is not the same as an adjustable-rate mortgage (ARM), in which the rate is fixed for a set period of time before adjusting to a variable rate.3 A 5/1 hybrid ARM, for example, has a fixed rate for the first five years, with the rate adjusting annually each year after that, based on the performance of an underlying benchmark rate.

The Bottom Line: Is it worth it?

Negotiations about price and seller concessions are part of every real estate transaction. A mortgage buydown could be worth if it you are able to save money on your interest rate during the initial part of the loan term. It's important, however, to consider what you might pay for the buydown fee and how long you plan to stay in the home to gauge your total savings. A seller-paid rate buydown strategy offers more benefits for all parties involved in the long run:

- Offering a below-market interest rate for the property will entice more buyers

- Saves the seller money upfront

- Saves the buyer money in the long run with lower payments and a lower interest rate

- Helps hold home values for the area

- Avoids the stigma of a price reduction

- Get buyers into homes when they're ready - not the market.